Maximizing Your Sales Potential: How to Calculate Sales Commissions for SaaS

Structuring a well-designed sales compensation plan is crucial for any company, but in the subscription-based software (SaaS) market, it is as crucial as the quality of the product itself. Companies struggle to efficiently design sales commission plans for SaaS because of a lack of understanding of what it takes to sell SaaS.

The best people to help optimize compensation for sales reps in SaaS are the RevOps team members.

Revenue Operations (RevOps) aims to coordinate sales, marketing, and customer success departments to optimize revenue growth. RevOps can help ensure that your sales compensation plan aligns with the company's objectives.

This blog will discuss how to calculate sales commissions for SaaS and develop a compensation plan that maximizes sales potential, taking into account your business goals, revenue model, budget, and commission structure.

Before you get started with calculating sales commissions, it is essential to have a comprehensive sales compensation plan. Let's begin where most great stories start- At the beginning!

Calculating commission on sales: Types of SaaS sales commission structures

To motivate reps and boost revenue growth, companies can use various types of commission structures for Software as a Service (SaaS) sales. Nowadays many companies try to mix-and-match when it comes to sales compensation structures. The right answer is different for every company, so be sure to involve your sales reps in the design stage of your sales commission plan- after all, they know their daily operations the best.

The compensation structure created for the existing employee might not be appropriate for the employee who joined as a fresher. This is where a hybrid and detailed commission structure accounting for diverse scenarios is useful. This commission structure combines different commission structures to motivate sales reps based on various revenue streams. For example, a company may offer a flat commission on new sales and a recurring commission on renewals.

The following are some common commission structures that are revenue-oriented:

- Base Only (Flat Salary): Base Only also known as Flat Salary, is a type of compensation structure where an employee receives a fixed amount of pay for a specified period, regardless of their performance or the company's revenue. There is no performance-based incentive involved.

- Straight Commission: This commission structure is the simplest, where sales representatives receive a fixed percentage of the revenue generated by the deals they close. All compensation is performance-related.

Earnings = Sales x Commission Rate - Base Plus Commission: In this structure, the base salary provides a guaranteed income to the employee, while the commission incentivizes them to increase their sales or productivity.

Earnings = Base Pay + (Sales x Commission Rate) - Tiered Commission: In this structure, sales reps receive higher commissions as they hit certain revenue targets. (Example- 2% up to $20k, 5% on next $30K, 8% on next $30K, etc. ). This provides aggressive motivation at every point.

Earnings = Sales in Tier x Commission Rate for Tier (For every tier) - Revenue Commission: It is typically calculated as a percentage of the total sales revenue or the profit margin of a sale. The salesperson is incentivized to increase sales revenue and profits, as their commission increases proportionally.

Earnings = Sales x Commission Rate - Gross Margin Commission: In this structure, sales reps get paid based on the profit margin of the deals they close. This encourages reps to focus on high-margin deals and is particularly useful for companies with complicated pricing structures. To get a clearer picture of the profit you’re actually generating on each deal, you can use a profit margin calculator to estimate margins quickly and ensure commissions align with company profitability.

Earnings = (Total Sales Price-Cost) x Commission Rate - Draw Against Commission: A "draw" or "advance" on commissions is given to salespeople at the beginning of each pay period. It's like an interest-free loan against their future commissions. If the commissions earned are more than the draw, the salesperson keeps the difference as their commission payment.

But if the commissions are less, the salesperson must repay the difference to the company in the next pay period. The draw helps the salesperson receive a steady income while working to increase their sales.

Commission Draw = Total Commission - Draw - Recurring Commission: This commission structure is suitable for SaaS companies with subscription-based revenue models. Sales reps receive a commission on the monthly or yearly recurring revenue generated by the customers they acquire.

Earnings = Customer Payment x Commission Rate - Territory Volume Commission: Territory Volume Commission is a type of sales commission structure that rewards sales representatives based on the volume of sales they generate within a specific geographic territory.

This commission plan is typically used by companies that have a well-defined sales territory structure and want to incentivize their sales reps to focus on generating sales within their assigned territories.

Earnings = (Total Sales x Commission Rate) / Number of Salespeople

- Multiplier Commission Plan: The multiplier commission is a personalized compensation plan that combines features of revenue commission and tiered commission structures. It begins with a fundamental revenue commission structure, and then a specific percentage factor is multiplied based on the sales representative's performance.

Earnings = Sales x Commission Rate Based on Percentage of Quota

Business objectives for a SaaS business and how it ties into designing a sales compensation plan

Business goals are essential for SaaS businesses, as they provide direction and aim for revenue growth, customer acquisition, and retention. Specific objectives may include increasing annual recurring revenue (ARR), expanding into new markets, or increasing customer lifetime value (CLV).

Creating a compensation plan for a SaaS sales team requires aligning with business objectives and considering specific sales roles. A commission structure that rewards reps for closing high-value deals or achieving quotas can increase revenue. Meanwhile, rewarding reps for bringing in new customers can improve customer acquisition. Hence, an ideal compensation system works to reward as many positive metrics for the organization as it can.

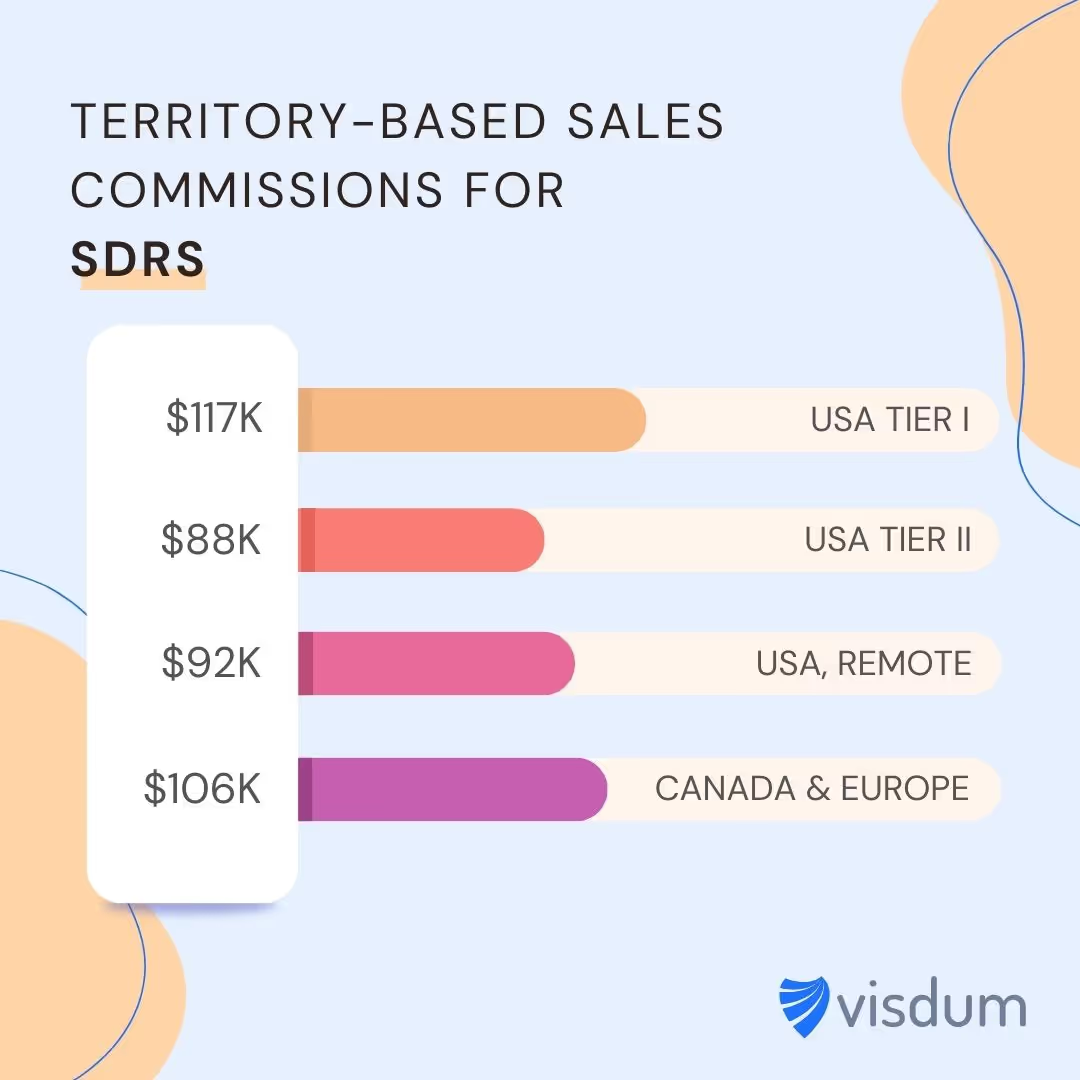

Commission percentage should differ for different sales roles and departments. For example, an SDR may earn commissions based on the number of qualified leads generated, while an AE's commissions may be based on the number and size of deals closed. Compensation plans should motivate and incentivize reps with a transparent, understandable, and clear path to success.

Below are some common business objectives for SaaS companies and how they relate to creating a compensation plan from a revenue perspective:

- Revenue Growth: Driving revenue growth is a primary objective for any SaaS company. To achieve this, the compensation plan should incentivize sales reps to close more deals and bring in new business.

- Customer Retention: Customer retention is critical to the long-term success of SaaS companies that use a subscription-based revenue model. To achieve this objective, the compensation plan should incentivize reps to focus on customer satisfaction and retention.

- Profitability: While revenue growth is essential, maintaining profitability is also crucial for SaaS companies. To achieve this objective, the compensation plan should incentivize reps to focus on deals with high-profit margins or to sell add-on services that increase profitability.

- Market Penetration: For SaaS companies entering new markets or competing with established players, market penetration is a key objective. To achieve this, the compensation plan should incentivize reps to focus on winning market share and closing deals with strategic customers.

Factors that influence SaaS Sales Commission Calculation

Whether you want to calculate sales commission for your AEs, SDRs, BDRs, or CSMs, there are several factors that influence these calculations. Let's dive into each of these:

- Pricing model: The pricing model of the SaaS business can have a significant impact on commission calculation. For example, if the business offers a subscription-based pricing model, the commission may be based on the recurring revenue generated from the customer.

- Sales cycle length: The length of the sales cycle can also influence commission calculation. If the sales cycle is longer, the commission may be higher to incentivize sales reps to put in the effort required to close the deal. Also, a base salary component can help sales reps sustain themselves in periods of no closure since sales cycles are long.

- Sales quota: The sales quota, or the minimum amount of revenue that a sales rep is expected to generate within a certain period, can impact commission calculation. The commission structure may be designed to incentivize reps to meet or exceed their quota.|

- Customer type: The type of customer that the sales rep is working with can also impact commission calculation. For example, if the SaaS business targets enterprise-level customers, the commission may be higher to reflect the larger deal size and longer sales cycle.

- Sales territory: The sales territory, or the geographic region that the sales rep is responsible for, can also influence commission calculation. If the sales territory is larger or more challenging, the commission may be higher to reflect the additional effort required to close deals in that area.

- Sales role: The commission structure may vary depending on the sales role within the SaaS business. For example, the commission structure for an account executive may be different than that for a sales development representative.

- Sales performance: Finally, the performance of the sales rep can also impact commission calculation. If a sales rep consistently exceeds their sales quota or achieves other performance metrics, they may be rewarded with higher commission rates or bonuses.

How to Calculate Sales Commission for SaaS

There are two main strategies when it comes to calculating commissions using recurring revenue:

1. Upfront commission with recurring revenue

In an upfront commission structure, the sales representative is paid a lump sum commission at the time the sale is made, even if the revenue is generated through recurring payments. For example, if a sales rep sells a $10,000 annual subscription with a 10% commission rate, they would receive a $1,000 commission upfront, even though the revenue will be generated over the year.

Calculating upfront sales commission for sales reps requires several key pieces of information:

- Sales rep commission rate: This is the percentage of the sale price that the sales rep will receive as a commission

- Sales rep quota: This is the target amount of revenue or the number of sales that the sales rep is expected to achieve in a given period

- Sales price: This is the price of the product or service being sold

With these pieces of information, you can calculate the upfront commission for each sale using the following formula:

Upfront commission = Sales rep commission rate x Sales price

2. Overtime commission with recurring revenue

In an overtime commission structure, the sales representative is paid commission on a recurring basis, based on the recurring revenue generated from the sale. For example, if a sales rep sells a $10,000 annual subscription with a 10% commission rate and a 12-month payment plan, they would receive a commission of $83.33 per month ($10,000 / 12 months x 10% commission rate).

Calculating overtime sales commission for sales reps requires several key pieces of information:

- Sales rep commission rate: This is the percentage of the sale price that the sales rep will receive as a commission

- Sales rep quota: This is the target amount of revenue or the number of sales that the sales rep is expected to achieve in a given period

- Sales price: This is the price of the product or service being sold

- Contract or subscription period: This is the length of time over which the customer will be paying for the product or service

With these pieces of information, you can calculate the overtime commission for each sale using the following formula:

Over time commission = Sales rep commission rate x Sales price x Contract or subscription period

Both upfront and overtime commission structures have their advantages and disadvantages when it comes to calculating commissions using recurring revenue.

- An upfront commission structure can provide immediate motivation to the sales representative, but may not incentivize them to focus on customer retention or upselling.

- An overtime commission structure, on the other hand, can incentivize sales representatives to focus on customer retention and upselling, as they will continue to receive a commission for the duration of the customer's subscription period.

Over time many companies have realized that when it comes to calculating sales commissions, using Excel is just not an option anymore. Missing numbers, adding extra decimals, and forgetting to close the brackets are some very common mistakes that lead to a huge change in the entire data. Here's a detailed read on why you should move away from excel spreadsheets for calculating SaaS sales commissions.

3. Commission Rates: What should be the ratio of base & variable salary during the first time of salary release?

Considerations such as industry, the state of the talent market, and the company's financial health all play a role in determining the base salary to variable salary ratio in a startup's compensation plan. Yet, it is generally accepted that in the early stages of a company's lifecycle, the variable income offered is greater than the base salary. Since many companies have limited funds, paying salespeople a greater variable income can encourage them to work harder and bring in more money.

60-70% variable salary and 30-40% base salary is a common early-stage business compensation ratio.

While this is a good rule of thumb, the specific ratio should be adjusted based on the demands of the business and the sales force.

Startups should take into account the following when determining the appropriate base salary to variable income ratio:

- Business goals: Sales quotas and corporate objectives should both be factored into the design of the remuneration structure.

- Sales team performance: The ratio between a salesperson's basic pay and commission should be determined by the team's projected and actual success.

- Financial situation: Since a highly variable wage could put the company in danger financially, it is important to take the company's financial status into account while setting the ratio.

- Competitiveness of the talent market: A bigger amount of variable pay may be required to entice and retain top talent if the company operates in a highly competitive talent market.

Need to implement multiple commission rates instantly across the org? Check out how Visdum's Rate Table allows you to do exactly that.

If you're looking for practical advice/tips and tricks on creating your SaaS sales comp plan, Anna Talericko, CEO of Corporate Finance Institute does a phenomenal job of detailing it all.

How an efficient sales compensation plan boosts sales performance

A survey conducted by Harvard Business Review Analytic Services found that companies with highly effective sales compensation plans are 81% more likely to have salespeople who exceed their quotas than companies with less effective plans.

A company’s success relies heavily on its sales team to reach sales goals, and a well-planned compensation plan is vital to build a motivated and high-performing sales rep. The compensation plan should align with the company's business objectives, be competitive in the job market, and cater to the sales team's capabilities and needs.

Moreover, recognizing exceptional performance is crucial in creating a sales culture that rewards effort and success. Publicly acknowledging outstanding work can motivate salespeople to perform better and retain top talent. Promotions and bonuses are some ways to appreciate and promote high achievers on the sales staff, which helps them feel connected to the company's goals, boosts morale, and promotes loyalty.

How Visdum helps you automate commissions

Visdum is a Sales Compensation Software tailor-made for mid-market businesses. We make it easy to design and automate sales commission plans, no matter their complexity or scale. Just create your plan, integrate your data sources, and you are all set up to enjoy a great sales comp experience.

Our no-code platform empowers your business to build desirable compensation plans, with the flexibility to add SPIFFs, Bonuses, or Kickers, while our powerful CRM or ERP integrations ensure that data is reliably sourced and accurate.

With Visdum, you can:

Integrate your Data Sources to Sync Data Everywhere

With just a few clicks, Visdum integrates with your CRM, HRMS, Invoicing systems, etc. to ensure that commissions are calculated on authentic data in real-time.

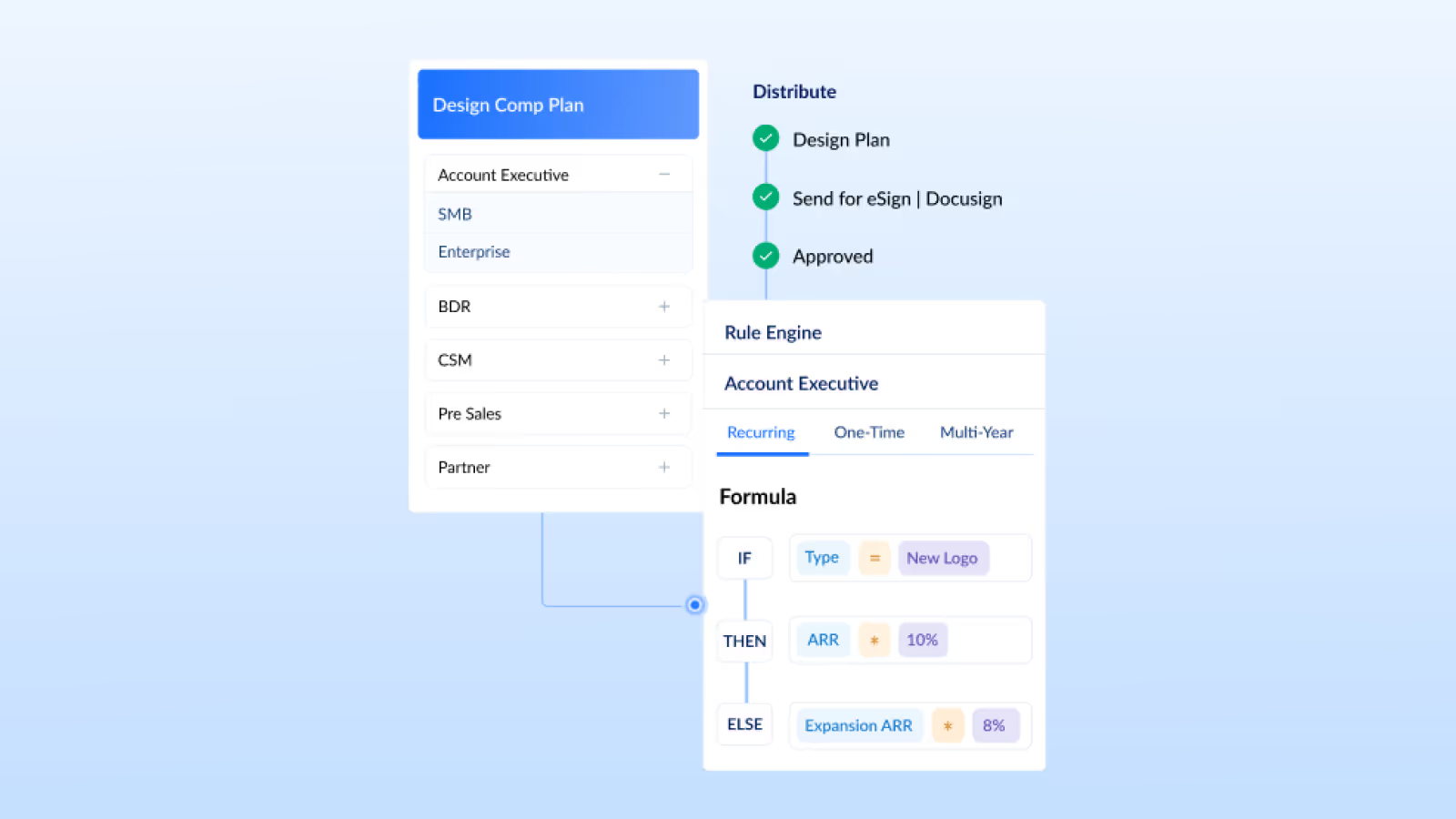

Design and Implement Compensation Plans with Ease

With our no-code plan designer, Visdum helps you design even the most complex type of Sales Comp plan and allows complete visibility to everyone involved - from Sales, and RevOps to Finance. Check out this blog to explore how Visdum helps SalesOps automate payouts.

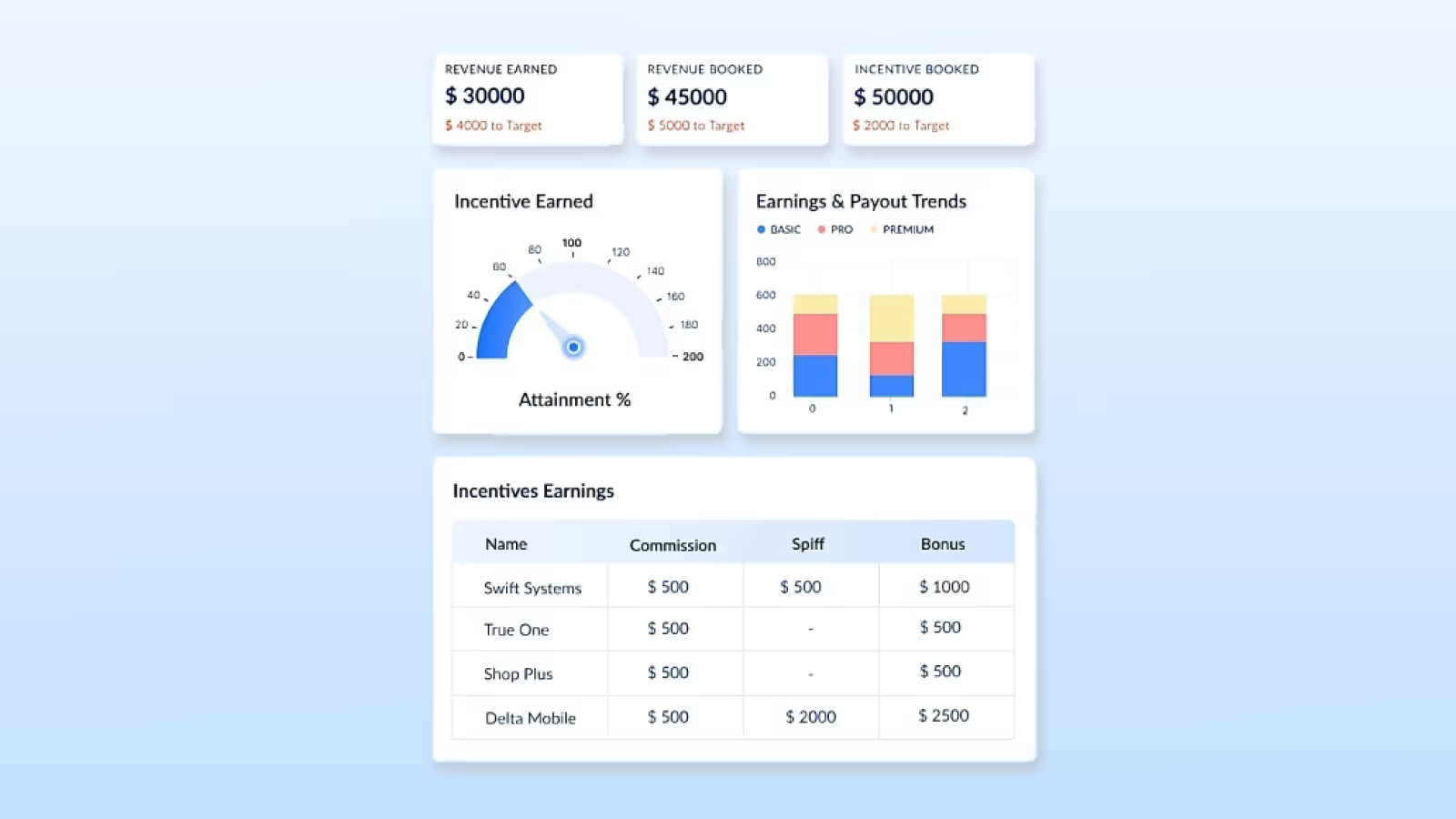

Ensure Complete Visibility And Gain Insightful Analytics

With our calculation engine, run and see your commission calculations across any rep, plan, and pay period in real time. We summarize data into reports and your dashboard to see compensation trends and insights.

Reduce Time On Payouts and Commission Reconciliation

Always be ready for auditing and compliance, and drastically reduce time spent organizing commissions for payroll input.

Ready to move on from spreadsheets? Book a demo to get in touch with us. You can also go through Visdum vs Spreadsheets to know what automation looks like for you.

FAQs

What is the formula for sales commission?

The sales commission formula is: Commission = (Sales Revenue * Commission Rate). Multiply the total sales revenue by the commission rate (expressed as a decimal) to calculate the commission earned by a salesperson.

How do you calculate sales commission rate for SaaS?

To calculate SaaS sales commission rates, determine the commission percentage based on factors like deal size, recurring revenue, and customer contract terms. Common methods include flat rates, tiered structures, or a percentage of monthly or annual recurring revenue (MRR or ARR). Adjust based on company goals and sales strategies.

How do you calculate commission for sales reps in SaaS?

Calculate sales reps' commission by applying a percentage to the total sales value. Typically, the commission rate ranges from 2% to 10%, varying based on industry standards, sales goals, and the structure of the commission plan. Adjustments may apply for different performance tiers or quotas.

Is SaaS sales commission calculated on gross or net sales?

Sales commission in SaaS is typically calculated on gross sales, not net sales. The commission is based on the total contract value or recurring revenue generated from the sale before deducting any expenses or discounts.

What is the typical sales commission rate for SaaS?

The typical sales commission rate for SaaS (Software as a Service) ranges from 5% to 20% of the contract value. Rates vary based on factors like deal size, sales cycle length, and company objectives, with some structures including recurring commissions for subscription renewals.

What is the commission rate for independent sales reps in SaaS?

The commission rate for independent sales reps in SaaS varies but commonly ranges from 10% to 30% of the recurring revenue. It depends on factors such as the sales agreement, contract length, and the strategic importance of the deal to the SaaS company.

What is the easiest method to evaluate the performance of salespeople?

The easiest method to evaluate SaaS salespeople is through Key Performance Indicators (KPIs) such as Monthly Recurring Revenue (MRR), Customer Acquisition Cost (CAC), and Customer Lifetime Value (CLV). These metrics provide insights into sales efficiency, revenue impact, and customer retention.

What is the average sales commission for a SaaS account executive?

The average sales commission for a SaaS account executive typically ranges from 10% to 20% of the Annual Contract Value (ACV) or Annual Recurring Revenue (ARR). It may vary based on factors like deal size, sales strategy, and company policies.

How do account managers make commission in SaaS sales?

Account managers in SaaS sales often earn commissions based on upsells, cross-sells, and renewals. Commissions are tied to the expansion of existing customer contracts, encouraging account managers to drive customer satisfaction, retention, and the overall growth of the customer relationship.

Do SaaS sales managers work on commissions?

Sales managers in SaaS typically do not work on direct commissions for individual sales. Instead, they often receive performance bonuses, salary, or a combination of both. Their focus is on overseeing and optimizing the sales team's performance rather than securing individual deals.

.webp)

.webp)