What is Annual Recurring Revenue (ARR)?

Annual Recurring Revenue (ARR) is the predictable subscription revenue a SaaS company expects to earn every year from its active customers. It helps companies forecast growth, evaluate financial stability, and make smarter revenue decisions. In simple terms: ARR shows the annual recurring revenue your subscription business generates, excluding one-time payments.

What Is Annual Recurring Revenue (ARR)?

If you run a subscription business, especially in SaaS, annual recurring revenue (ARR) is one of the most important metrics you’ll track.

ARR measures the total predictable subscription income your business expects to earn over 12 months. Since SaaS companies operate on subscription pricing models, ARR gives a clear snapshot of recurring revenue performance and long-term business health.

Example: Let’s break this down with a simple example:

If a SaaS company signs a customer for a three-year subscription worth $36,000, paid monthly at $1,000:

- Total contract value = $36,000

- Annual recurring revenue = $12,000

This occurs because ARR focuses solely on annual recurring subscription revenue rather thanannual recurring subscription revenue, not the total contract value.

Why ARR Matters for SaaS Businesses?

ARR SaaS metrics extend beyond revenue tracking. They help companies understand performance, forecast growth, and improve operational planning.

Here’s why ARR or Annual Recurring Revenue is critical:

1. Predictable Revenue Forecasting

ARR helps businesses estimate future recurring income, making financial planning more accurate.

2. Business Health Indicator

A high annual recurring revenue typically signals strong customer retention and stable revenue streams.

3. Investor & Valuation Metric

Investors closely track ARR growth because predictable subscription revenue reflects scalability and long-term sustainability.

4. Helps Calculate Other SaaS Metrics

ARR plays a major role in calculating:

- Customer Lifetime Value (LTV)

- Customer Acquisition Cost (CAC)

- Average Revenue Per Account (ARPA)

These metrics together help SaaS companies understand profitability and growth potential.

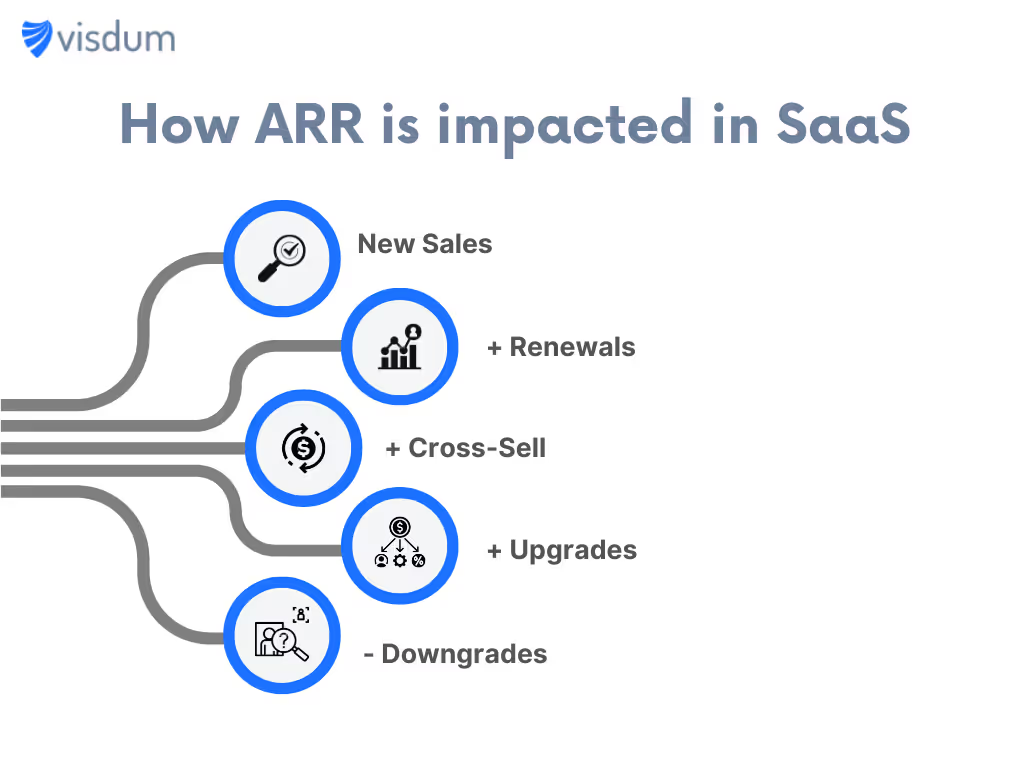

Key Factors That Affect Annual Recurring Revenue

Annual recurring revenue doesn’t stay static. Several SaaS revenue events can increase or decrease ARR. Understanding these drivers helps teams optimize revenue growth and retention strategies.

1. New Sales Increase ARR

Every new subscription sale directly increases ARR. Example: If you sell a new annual subscription valued at $1,000, your ARR increases by $1,000.

2. Subscription Renewals Strengthen ARR Stability

When customers renew subscriptions, ARR grows, and revenue predictability improves. Example: If an existing customer renews their annual subscription for $1,000, ARR increases by $1,000.

3. Cross-Selling Expands ARR Per Customer

Selling additional SaaS products or add-ons to existing customers increases annual recurring revenue. Example: If an existing customer purchases an additional $500 product annually, ARR increases by $500.

4. Upgrades and Downgrades Adjust ARR

Subscription plan changes impact ARR directly:

- Upgrades increase recurring revenue

- Downgrades reduce recurring revenue

Example:

- Upgrade from $500/year to $1,000/year → ARR increases by $500

- Downgrade from $1,000/year to $500/year → ARR decreases by $500

Quick Insight: Most high-growth SaaS companies focus heavily on expansion revenue (upgrades + cross-sell) because it increases ARR without acquiring new customers.

Check out the best SaaS examples in different business niches here- SaaS Examples: The Best SaaS Tools for Each Business Function

How to Calculate Annual Recurring Revenue?

Before we dive into the ARR formula, let's look at the factors that need to be considered to calculate Annual Recurring Revenue (ARR).

To calculate Annual Recurring Revenue (ARR) using contract value:

- Determine the contract length: This is the length of time that the customer has committed to using your product or service. For example, a three-year contract under a subscription model means they will continue contributing to your annual revenue for the next 3 years.

- Calculate the contract value: This is the contract's total value over the contract length. For example, if the customer signs a three-year contract for $12,000, the contract value is $12,000, and the annual revenue under a subscription business model would be $4,000.

- Divide the contract value by the contract length: This will give you the Annual Recurring Revenue (ARR). For example, if the contract value is $15,000 and the contract length is three years, the ARR would be $15,000 divided by 3 or $5,000 per year.

Note that this method assumes payments are regular and fixed in amount, so the entire contract value is distributed evenly over the contract length. This is the essence of the subscription mode. SaaS companies sell software as a service customers can subscribe to by paying monthly or annual subscription charges.

Annual Recurring Revenue (ARR) Formula using Monthly Recurring Revenue (MRR)

ARR: To calculate ARR, we multiply the MRR by 12 (the number of months in a year).

How is Annual Recurring Revenue (ARR) different from Annual Contract Value (ACV)?

While Annual Recurring Revenue (ARR) and Annual Contract Value (ACV) are both important metrics used to measure the revenue generated by SaaS companies, they represent slightly different calculations.

ARR represents the predictable and recurring revenue that a SaaS company expects to generate over 12 months from its customers. It is calculated based on the sum of all subscription revenue that a SaaS company expects to receive annually from its customers.

In contrast, ACV represents the total value of contracts signed with customers over 12 months. It takes into account any one-time fees, such as setup fees or professional services fees, that may be included in the contract in addition to recurring subscription revenue.

To illustrate the difference between ARR and ACV, let's consider an example.

Suppose a SaaS company signs a 12-month contract with a new customer for a monthly subscription fee of $100. In addition, the contract includes a one-time setup fee of $1,000. Using this scenario, the ARR for this customer would be $1,200 ($100/month x 12 months), while the ACV would be $2,200 ($1,000 setup fee + $100/month x 12 months).

So, in summary, ARR focuses solely on the recurring revenue generated by a SaaS company from its customers, while ACV takes into account any one-time fees included in contracts signed with customers. It is the annualized value of money coming in from contracts.

How is Annual Recurring Revenue (ARR) Related to Monthly Recurring Revenue (MRR)?

Annual Recurring Revenue (ARR) and Monthly Recurring Revenue (MRR) are closely related metrics that are often used by SaaS companies to measure their revenue streams.

ARR represents the predictable and recurring revenue that a SaaS company expects to generate over 12 months from its customers. ARR is calculated by multiplying the average monthly recurring revenue (MRR) per customer by the total number of customers in a given period, and then multiplying that by 12 (the number of months in a year). ARR can also be calculated from the contract value

MRR, on the other hand, represents the predictable and recurring revenue that a SaaS company generates from its customers every month. It is calculated by taking the monthly subscription fees per customer in a month and multiplying it by the number of customers.

MRR is a valuable metric because it provides insight into the health and predictability of a SaaS company's revenue stream on a month-to-month basis. By tracking changes in MRR over time, SaaS companies can identify trends and make adjustments to their pricing or marketing strategies as needed.

ARR is a more holistic view of a SaaS company's revenue stream, as it takes into account the total revenue generated from customers over 12 months or a year. While MRR provides a more granular view of monthly revenue, ARR provides a broader perspective on the overall financial health of a SaaS business.

How Does Annual Recurring Revenue (ARR) Contribute to Customer Lifetime Value (LTV)?

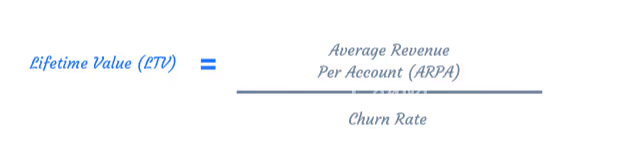

Annual Recurring Revenue (ARR) and Customer Lifetime Value (LTV) are two key metrics used by SaaS companies to measure the financial performance of their businesses, and they are related to each other.

ARR represents the predictable and recurring revenue that a SaaS company expects to generate over 12 months from its customers. In contrast, LTV is a metric that calculates the total revenue a SaaS company expects to receive from a customer over the entire duration of its relationship with the company.

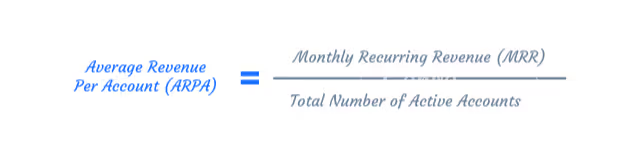

To calculate LTV, you need to know several other metrics, such as customer acquisition cost (CAC), customer churn rate, and average revenue per account (ARPA). Once you have these metrics, you can calculate LTV by multiplying ARPA by the gross margin and then dividing that by the customer churn rate. The result is the expected revenue a company will earn from a customer over their entire relationship with the company.

So, how are ARR and LTV related? ARR is one of the key components used to calculate LTV. Specifically, the ARPA metric used in the LTV calculation is equal to ARR divided by the total number of customers. In other words, ARR is a measure of the predictable, recurring revenue generated by each customer, and this information can be used to estimate the average revenue a customer will generate over their lifetime with the company.

In summary, while ARR provides a snapshot of a SaaS company's annual recurring revenue, LTV takes a longer-term view of the revenue generated by each customer over their lifetime with the company, and ARR is a key component used in the LTV calculation.

How to Calculate ARR, MRR, ARPA, TCV, ACV, and LTV for a SaaS Business:

Let's walk through an example to illustrate how Monthly Recurring Revenue (MRR), Annual Recurring Revenue (ARR), Annual Contract Value (ACV), and Customer Lifetime Value (LTV) are calculated.

Suppose a SaaS company offers its product for a

- Monthly subscription fee of $100, and a

- One-time setup fee of $500 for new customers

Monthly Recurring Revenue Calculation

To calculate MRR, we simply multiply the number of customers by the average monthly subscription fee. In this case, the MRR would be $100,000 ($100/month x 1,000 customers).

Annual Recurring Revenue Calculation

To calculate ARR, we multiply the MRR by 12 (the number of months in a year). The ARR for this SaaS company would be $1,200,000 ($100,000/month x 12 months).

Average Revenue Per Account Calculation

ARPA (Average Revenue per Account) per month = MRR / Number of Customers = $100,000 / 1,000 = $100

Customer Lifetime (in years) = 1 / Churn Rate = 1 / 0.1 = 10 years

LTV = ARPA x Customer Lifetime = $100 x 10 yrs x 12 months/yr = $12,000

If the company signs a two-year contract then:

TCV: Total Contract Value = Monthly Subscription * 24 + One Time Setup = $100 * 24 + $500 = $2,900

Annual Contract Value Calculation

To calculate ACV, we need to account for any one-time fees included in customer contracts. Therefore, the ACV would be $2,900/2 years.

ACV = TCV / Contract Term Length in Years.

Lifetime Value Calculation

To calculate LTV, we need to know several other metrics, such as customer acquisition cost (CAC), and customer churn rate. Let's assume the CAC is $1,000, the churn rate is 10% per year. Using these metrics, we can calculate LTV as follows:

LTV = ARPA / Churn Rate = $1000 / 0.1 = $10,000

So, in summary:

- MRR = $100,000

- ARR = $1,200,000

- ARPA = $100 monthly

- TCV = $2,900

- ACV = $1,450

- LTV = $12,000

These metrics provide valuable insights into the company's financial performance and can inform decisions on pricing, marketing, and customer acquisition strategies.

If you're interested in learning more, here's an in-depth video explanation by Chargebee.

Why Annual Recurring Revenue Matters for SaaS Growth

Annual recurring revenue is more than a financial metric; it reflects the long-term sustainability of subscription businesses.

ARR helps companies:

- Forecast revenue growth

- Improve customer retention strategies

- Track predictable subscription performance

- Support investor evaluation

- Strengthen revenue planning and forecasting

Conclusion: ARR Is the Backbone of SaaS Revenue Strategy

Recurring revenue is one of the biggest advantages of SaaS businesses. While it provides predictable, stable cash flow, it also creates challenges, including customer churn and retention pressures.

That’s why modern SaaS companies focus heavily on improving customer qualification, subscription expansion, and revenue predictability.

To support these goals, sales compensation and incentive strategies must align closely with recurring revenue growth. Platforms like Visdum help SaaS teams design commission structures that encourage long-term customer retention and sustainable ARR growth.

If you're building or optimizing SaaS incentive plans, check out the guide to building sales compensation plans tailored to subscription businesses.

Frequently Asked Questions

1. What is annual recurring revenue in SaaS?

Annual recurring revenue (ARR) measures the predictable subscription income a SaaS company generates yearly. It excludes one-time payments and focuses only on recurring revenue streams.

2. How do you calculate annual recurring revenue?

ARR can be calculated by:

- Multiplying Monthly Recurring Revenue by 12

- Dividing the total contract value by the contract duration

Both methods measure yearly subscription income.

3. Is ARR the same as total revenue?

No. ARR includes only recurring subscription revenue, while total revenue includes one-time fees, services, and other income streams.

4. What is the difference between ARR and MRR?

MRR measures monthly subscription revenue, while ARR measures annual subscription revenue. ARR is typically MRR multiplied by 12.

5. What is the difference between ARR and ACV?

ARR measures recurring subscription income, while ACV measures total contract value, including one-time fees and services.

6. Why do SaaS companies track ARR?

SaaS companies track ARR to measure predictable revenue growth, improve forecasting accuracy, evaluate customer retention performance, and support investor reporting.

7. Does ARR measure profitability?

No. ARR measures recurring revenue but does not account for operational expenses or customer acquisition costs. Profitability requires analyzing multiple financial metrics alongside ARR.

Final Takeaway

Understanding annual recurring revenue SaaS metrics helps companies track predictable growth, improve subscription retention, and build sustainable revenue strategies. When combined with metrics like MRR, ACV, and LTV, ARR becomes a powerful indicator of long-term SaaS success.

.webp)

.webp)

.webp)