A Practical Guide to ASC 606 Sales Commissions (+ Sample Reports)

In all my years leading sales teams, ASC 606 has been “the” game-changing revenue recognition standard from FASB (the Financial Accounting Standards Board) and IASB (the International Accounting Standards Board).

Introduced in 2014 and effective since 2018 for public companies, ASC 606 replaced standards like ASC 605 to standardize financial reporting across industries.

This shift was especially critical for SaaS businesses, where subscription-based revenue and sales commissions created inconsistencies under older rules.

For SaaS companies, ASC 606 is great.

It offers clear rules for recognizing revenue from subscriptions and handling sales commissions tied to long-term contracts—two areas that hit close to home for your business.

Whether you’re a CFO ensuring compliance or a finance professional optimizing your processes, this pillar page has you covered.

Expect a deep dive into ASC 606’s core principles, its five-step model, SaaS-specific examples, common challenges, and tools like sales commission software to make compliance seamless.

Core principles of ASC 606 sales commissions

ASC 606, also known as Accounting Standards Codification Topic 606, outlines the principles of revenue recognition in financial reporting. It is a joint standard from the Financial Accounting Standards Board (FASB) and the International Accounting Standards Board (IASB) and represents a significant change in accounting for revenue from contracts with customers.

ASC 606, focusing on revenue recognition, treats sales commissions as incremental costs directly tied to securing a contract. If certain criteria are met, these costs can be capitalized as assets.

The amortization of these commissions then occurs over the period, reflecting the benefits of the initial sale. Crucially, companies must disclose their amortization methods, asset amounts from contract-related costs, and any impairment losses recognized.

This approach necessitates estimating and aligning commission recognition with revenue, with specifics varying by industry and contract nuances, ensuring compliant and transparent accounting practices.

1. What are the 5 steps of ASC 606?

ASC 606, the revenue recognition standard, fundamentally changes how companies account for revenue from contracts with customers. Let's break down each of the five steps with simple explanations and examples:

a. Identify the Contract with the Customer

This involves recognizing a legal agreement between the SaaS company and its customer that outlines the terms of service provision and payment.

Example: A SaaS company enters into a 12-month subscription contract with a customer to use its software platform. This contract is legally enforceable and specifies the terms of usage and payment.

b. Identify the Performance Obligations in the Contract

Performance obligations are promises to deliver goods or services to the customer. In SaaS, this can include access to software, updates, and support services.

Example: The subscription contract includes two performance obligations: (1) providing ongoing access to its software, and (2) offering customer support and regular software updates.

c. Determine the Transaction Price

This is the amount the company expects to get paid for fulfilling its contract. This should include fixed amounts and may also consider variables like discounts or incentives.

Example: The customer agrees to pay $1,200 for a yearly subscription, paid monthly at $100 per month. Thus, the transaction price is $1,200.

d. Allocate the Transaction Price to the Performance Obligations in the Contract

If there are multiple performance obligations, the transaction price must be allocated to each based on their standalone selling prices.

Example: If access to the software is normally priced at $1,000 per year and customer support at $200 per year, the $1,200 payment is allocated based on these standalone selling prices.

e. Recognize Revenue When (or as) the Entity Satisfies a Performance Obligation

Revenue is recognized when the service is provided or as it's provided, depending on the nature of the obligation.

Example: For ongoing access to the software, revenue is recognized over time, so $100 is recognized each month. For customer support, if it's provided evenly throughout the year, revenue is also recognized monthly at a proportionate rate.

ASC 606 aims to provide a more robust framework for addressing revenue recognition matters, improve the comparability of revenue recognition practices across entities, industries, jurisdictions, and capital markets, and require enhanced disclosures.

The standard has had a significant impact on many organizations, particularly those with complex contracts or multiple performance obligations.

As the CFO of a SaaS company, it's vital to work closely with your accounting and sales teams to ensure that your company's commission accounting practices comply with ASC 606.

SaaS sales commissions under ASC 606

Let's take a hypothetical example to understand how ASC 606 impacts sales commission accounting.

Suppose your SaaS company enters into a contract with a customer for a subscription service:

Contract Term = 1 year

Annual Recurring Revenue = $120,000

Payment Terms = Annual Upfront

Under the new standard, your company cannot recognize all $120,000 as revenue upfront. Instead, your company must recognize revenue over the 1-year subscription period as the performance obligations are satisfied.

Given that your company has determined that the performance obligation is satisfied evenly over the subscription period, you will recognize $10,000 of revenue each month for the duration of the contract.

Further, your company has a standard commission rate of 10% for the sales team.

Step 1: To account for sales commissions under ASC 606, your company must estimate and recognize the commission expense when the related revenue is recognized.

In the above example, your company will recognize

10% of $10,000 = $1,000 of commission expense each month for the duration of the contract.

Step 2: Your company needs to capitalize on any commission costs incurred to obtain the contract and gradually liquidate them over the expected life of the contract.

For example, if a company incurred $5,000 in sales commissions to obtain the contract, they would capitalize on this amount and recognize $5,000/12 = $417 of commission expense each month for the 12-month contract period.

Under ASC 606, the company recognizes $10,000 of revenue and $1,417 of commission expense each month for the duration of the 1-year contract.

The expense includes both the estimated commission expense related to the performance obligation and the capitalized commission cost incurred to obtain the contract.

🔔 Must read for a complete understanding of the basics of ASC 606, 'The SaaS CFO's Blueprint: ASC 606 Compliance for Sales Commissions.'

What are the challenges faced by SaaS CFOs in implementing ASC 606 standards?

Implementing ASC 606 and ensuring compliance can be a complex and challenging process, particularly for companies that have historically used a different revenue recognition method.

Some of the difficulties that companies may encounter during ASC 606 implementation include:

1. Identifying all revenue streams

One of the first steps in implementing ASC 606 is to identify all revenue streams and determine the appropriate revenue recognition method for each. This is often a challenging process for companies with complex revenue streams or for those that offer a range of products or services.

ASC 606 brings a sea change in the broader revenue recognition landscape. It demands a holistic reevaluation of how revenue is reported, which is critical for maintaining compliance and financial accuracy.

🔔 Must read for a more detailed understanding of these changes and to explore the broader implications of ASC 606 on SaaS revenue recognition, "How ASC 606 Affects SaaS Revenue Recognition."

2. Assessing the impact on financial statements

ASC 606 can impact a company's financial statements in various ways, including the timing, amount of revenue, and cost recognition. Companies will need to precisely evaluate the impact of ASC 606 on their financial statements and ensure that they are presenting accurate and transparent financial information.

3. Addressing internal control

ASC 606 might require changes to a company's internal controls, particularly in the areas of contract management and revenue recognition. Companies will need to evaluate their internal control environment and make any necessary updates to ensure that they are compliant with the new standard.

4. Educating employees

Companies will need to provide education and training to employees involved in the revenue recognition process to ensure that they understand the requirements of ASC 606 and can comply with the new standard.

5. Ensuring system readiness

Organizations may need to make changes to their systems and processes to support compliance with ASC 606, such as updating financial reporting systems, modifying contract management processes, and implementing new controls. Revenue recognition software can be a huge benefit to maintain compliance and to streamline revenue operations.

Implementing ASC 606 can be a complex and challenging process that requires careful planning and execution. The route towards proper compliance encounters difficulties in identifying all revenue streams, assessing the impact on financial statements, addressing internal controls, educating employees, and ensuring system readiness.

Now that you have a good idea of what ASC-606 101 is, what the 5-step model is, and what problems most SaaS leaders face, let’s look at changes to SaaS contracts under ASC 606.

SaaS Contract Modifications under ASC 606

SaaS leaders often juggle evolving customer needs, leading to contract modifications. With ASC 606 in the mix, understanding how to treat these changes is crucial for accurate revenue recognition and delivering value.

1. Different Ways to Treat Contract Modifications

Under ASC 606, modifications can be:

As a Separate Contract: If there's a new obligation and a proportional price increase

Termination and Creation of a New Contract: If there are distinct services and a change in the contract’s consideration.

Part of the Original Contract: If there's no new distinct service.

2. Examples of Changes in SaaS Contracts

Adding More Users:

What Happened: A company bought 100 user licenses for a software at $100 each, totaling $10,000. Later, they wanted 50 more licenses.

How It's Handled: If the new licenses cost the same ($100 each), it's like starting a new contract. But if there's a special price for the added licenses, it might change the terms of the original contract.

Switching to a Better Plan:

What Happened: A customer, paying $500/month for a basic software plan, wants to move to a fancier plan costing $800/month, halfway through the year.

How It's Handled: If the fancier plan has extra features, it's like buying a new product. If not, the price change affects the original contract.

Making the Contract Longer:

What Happened: A company with a year-long software contract wants to use it for an extra six months without changing the monthly fee.

How It's Handled: This can be seen as a new contract for the extra six months. But if there are special offers or price changes for the added time, it might change the original contract's terms.

Adding More Services:

What Happened: A company's software package has access and support. Later, they want a data analysis tool from the same provider.

How It's Handled: If the data tool has its own price, it's like buying a new product. If it comes with a package deal, the original contract's price might need a rethink.

When changing a software contract, it's crucial to ascertain whether the changes are equivalent to buying a new product or an add-on service, to better understand how the contract price gets affected. It's always a good idea to talk to a expert to make sure everything's done right.

Once you have identified the best way to record your revenue, it all comes down to reporting it in the best manner possible. Let us understand this better with examples.

Audit-Ready Reports for ASC 606 Compliance

Understanding the intricacies of ASC 606 is crucial for SaaS leaders. Ensuring compliance not only safeguards against potential financial discrepancies but also fortifies trust with stakeholders. This section will guide you through creating audit-ready reports, tailored for the SaaS industry.

Every report is a story of your company's financial journey. Here's what each component signifies and how it ties back to ASC 606.

1. Revenue Recognition Schedule

This report tracks when and how much revenue the company records from its sales. It includes details like when a deal was made, who the customer is, and how much money is involved.

This table showcases how revenue is recognized over time, factoring in deferred revenue.

Key Takeaways

- Contract and Obligation: In case 1, the contract with ABC Corp, valued at $12,000, is for providing a software license.

- Recognized Revenue: As of now, $3,000 of the contract value has been recognized. This means the company has earned this amount based on the services it has already provided.

- Deferred Revenue: The remaining $9,000 is not yet earned and is considered deferred. This will be recognized as revenue over the course of the year, as the company fulfills its obligation of providing the software license.

- Revenue Recognition Date: By 31-Dec-2023, all the deferred revenue is expected to be recognized, completing the financial obligations of this contract.

2. Capitalized Sales Commissions

This report shows the costs of paying sales commissions and spreads these costs over time. It lists which salesperson got paid, for which deal, and how these payments are accounted for over months or years.

Dive into the treatment of sales commissions and their amortization.

Key Takeaways

- Commission Calculation: John Doe earned a commission of 10% on the $12,000 contract with ABC Corp, totaling $1,200.

- Amortization: This $1,200 commission is not expensed all at once. Instead, it's spread out over the contract's duration (1 year) at $100 per month.

- Alignment with Revenue: This method ensures that the commission expense is matched with the revenue being recognized from ABC Corp over the same period, aligning with the principle of matching expenses with related revenues.

3. Remaining Performance Obligations (RPO)

This report outlines what services or products the company still needs to deliver in the future and how these will affect its earnings. It includes information on each deal, how much money is still to be earned, and what's left to do.

A snapshot of obligations yet to be fulfilled and their impact on future revenue.

Key Takeaways

- Contract Progress: Of the total $15,000 contract value with Gamma Ltd, $3,750 has been recognized as revenue.

- Remaining Obligation: There is still a significant portion ($11,250) of the contract value that has not been recognized. This amount represents the services or products that the company is yet to deliver.

- Revenue Recognition Timeline: The company expects to recognize this remaining revenue throughout the year 2023 as it continues to fulfill its obligations under the contract.

4. Contract Modifications

Details any changes made to sales agreements and how these changes affect the company’s earnings. It shows the original deal, any changes made, and how these changes impact the company's revenue.

Grasp the challenges of handling contract changes and their influence on revenue recognition.

Key Takeaways

- Contract Change: The original contract with Epsilon Ent. was increased by $1,500 due to an upgrade in the software version.

- Financial Impact: This contract modification means that the company will now recognize an additional $1,500 in revenue on top of the original contract value.

- Adjustments Required: Such modifications require adjustments in revenue recognition schedules to accurately reflect the new total contract value and ensure compliance with ASC 606.

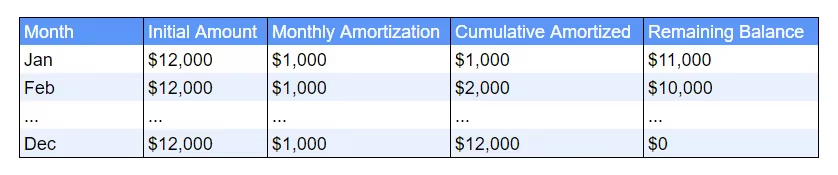

5. Amortization Detail/Waterfall Report:

The Waterfall report offers a transaction-level view of amortization. It provides a detailed breakdown of how an initial amount is amortized over time, showing the amount amortized each period, the cumulative amortized amount, and the remaining balance after each period.

Imagine a SaaS company capitalizes a sales commission of $12,000 for a 12-month contract. The Waterfall report would show how this commission is amortized monthly.

Key Takeaways

- Amortization Process: A sales commission of $12,000 is being amortized at $1,000 each month. This means every month, $1,000 of the commission is counted as an expense.

- Cumulative and Remaining: With each month, the cumulative amortized amount increases (total amount expensed so far), and the remaining balance (amount yet to be expensed) decreases.

- Year-End Balance: By the end of the year (December), the entire $12,000 will have been expensed, aligning the commission costs with the revenue recognized over the year.

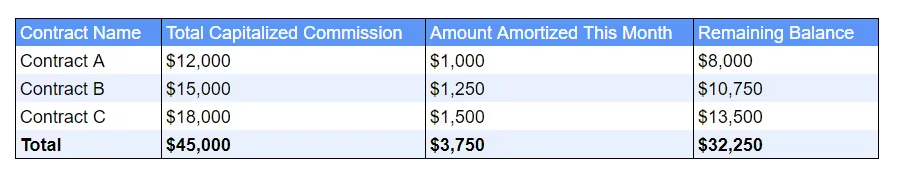

6. Amortization Summary/Consolidated Report:

The consolidated report provides a high-level overview of amortization across different contracts or assets. Instead of transaction-level details, it summarizes total amounts, amounts amortized in the current period, and remaining balances.

Imagine that the same SaaS company has three different contracts with capitalized commissions. The consolidated report would summarize the amortization for all these contracts.

Key Takeaways

The report lists each contract and provide key figures:

- Total Capitalized Commission: The initial commission amount for each contract.

- Amount Amortized This Month: How much of the commission has been expensed in the current month for each contract.

- Remaining Balance: The remaining commission amount to be expensed in future months for each contract.

- Consolidated View: This report offers a comprehensive view, combining data from multiple contracts. It helps in understanding the total financial impact of sales commissions at any given time.

- Monitoring Financial Health: By summarizing the total amortized amounts and remaining balances, the report provides insights into how much of the commission costs are still impacting the company's finances.

- Strategic Decision-Making: With this consolidated information, financial leaders can make informed decisions about budgeting, forecasting, and financial planning. It helps in assessing the overall burden of sales commissions on the company's profitability.

Get Your Free ASC 606 Sales Commission Amortization Template

Ready to put these reporting principles into practice?

We've created a free ASC 606 Sales Commission Amortization Reporting Template to help you get started immediately.

This comprehensive Excel template will save you hours in sales commission management by:

- Automatically calculating monthly amortization schedules

- Generating cumulative amortization reports

- Tracking deferred commission balances

- Simplifying compliance with ASC 606 requirements

Simply enter your commission details—including payment dates, payee names, opportunity names, and contract durations—and let the template do the heavy lifting for you.

Download Free ASC-606 Sales Commission Amortization Reporting Template Now

To Sum it Up

ASC 606 sales commission accounting isn't merely about compliance - it's about precision, strategy, and performance management.

Throughout my career leading sales teams, I've observed that the organizations that outperform their competitors aren't necessarily those with the most generous compensation plans - they're the ones with the most transparent, strategically aligned, and well-executed commission structures.

The transition to ASC 606 offers an inflection point. You can continue with fragmented systems, manual spreadsheets, and reactive approaches - or you can elevate sales compensation to the strategic function it deserves to be.

The most effective sales leaders I've known view commission accounting not as a necessary evil but as a performance lever. They understand that commission is about more than the money - it's about continuous feedback, behavior modification, and performance improvement.

In 2025, there's simply no justification for treating a 15-20% revenue allocation without the same rigor you apply to other strategic investments. The tools exist. The framework is clear. The opportunity is present.

The question isn't whether you'll comply with ASC 606 - it's whether you'll use this moment to transform how you approach sales compensation altogether.

Those who do will find themselves with more predictable revenue, more motivated sales teams, and a distinct competitive advantage in the marketplace.

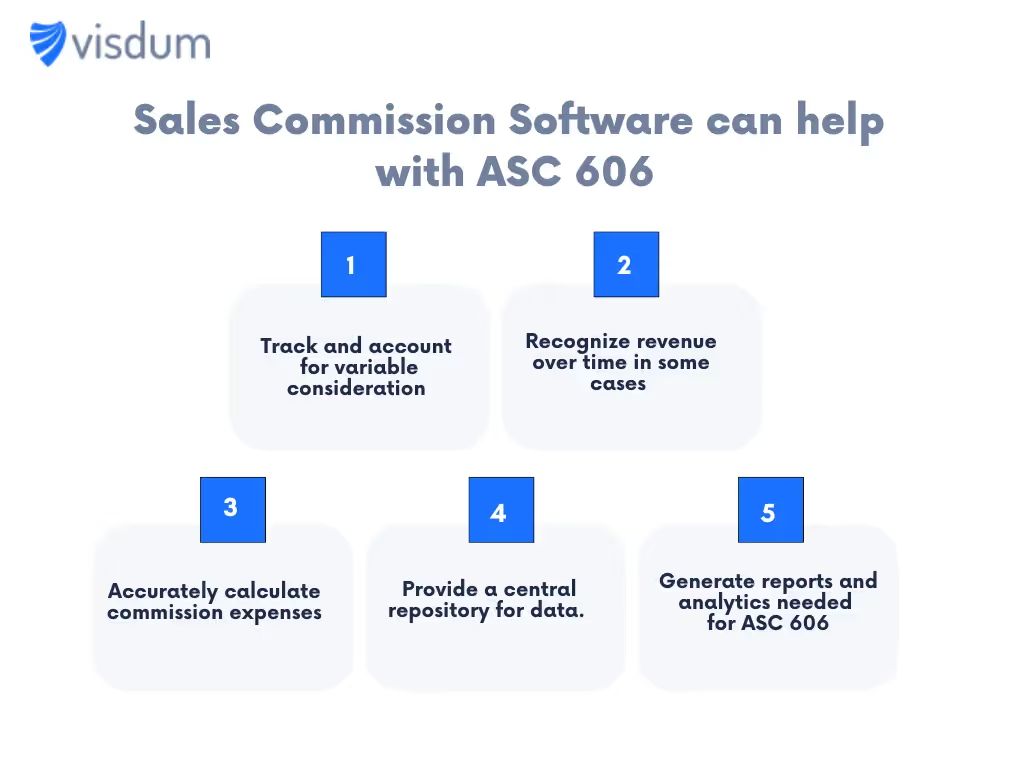

Can Sales Commission Software help comply with ASC 606?

Visdum's sales commission software is a vital tool for SaaS companies to ensure compliance with ASC 606. It enhances the accuracy and efficiency of tracking and reporting commission expenses. Below, we explore various ways in which this software facilitates compliance:

Key Benefits of Using Sales Commission Software

- ASC 606 Compliance with Variable Considerations: Sales commission software efficiently automates the tracking and calculation of commissions, including variables like discounts or refunds, ensuring that commission expenses align with ASC 606 standards.

- Synchronizing with Revenue Recognition: Particularly in subscription models, the software aligns the recognition of commission expenses with revenue, maintaining consistency with ASC 606's revenue recognition policies.

- Ensuring Accuracy in Commission Calculations: By automating the calculation process, the software guarantees that commission expenses are calculated precisely based on sales agreements, aligning with ASC 606.

- Central Repository for Compliance Data: The software serves as a central hub for all relevant sales transaction data, simplifying ASC 606 compliance for the finance team.

- Insightful Reporting for ASC 606: It generates detailed reports and analytics, providing insights into sales performance and aiding in identifying areas for improvement in ASC 606 compliance.

Investing in technologies like sales commission software for better ASC 606 compliance boosts transparency, accuracy, and real-time reporting.

Sales commission software not only simplifies the commission calculation process but also ensures accurate commission expenses and provides essential data for ASC 606 compliance. This tool is instrumental for companies in adhering to ASC 606 standards through automated tracking and precise commission calculations.

Understanding the right tools can make all the difference. Our extensive guide on ASC 606 compliance tools is designed to help you identify and leverage the best solutions for your business needs.

Simplify Your SaaS Sales Commission Accounting with Visdum

Transform your approach to ASC 606 compliance with Visdum, tailored for SaaS sales commission accounting. Experience the ease of automation and accuracy that come with our intuitive features and seamless integrations.

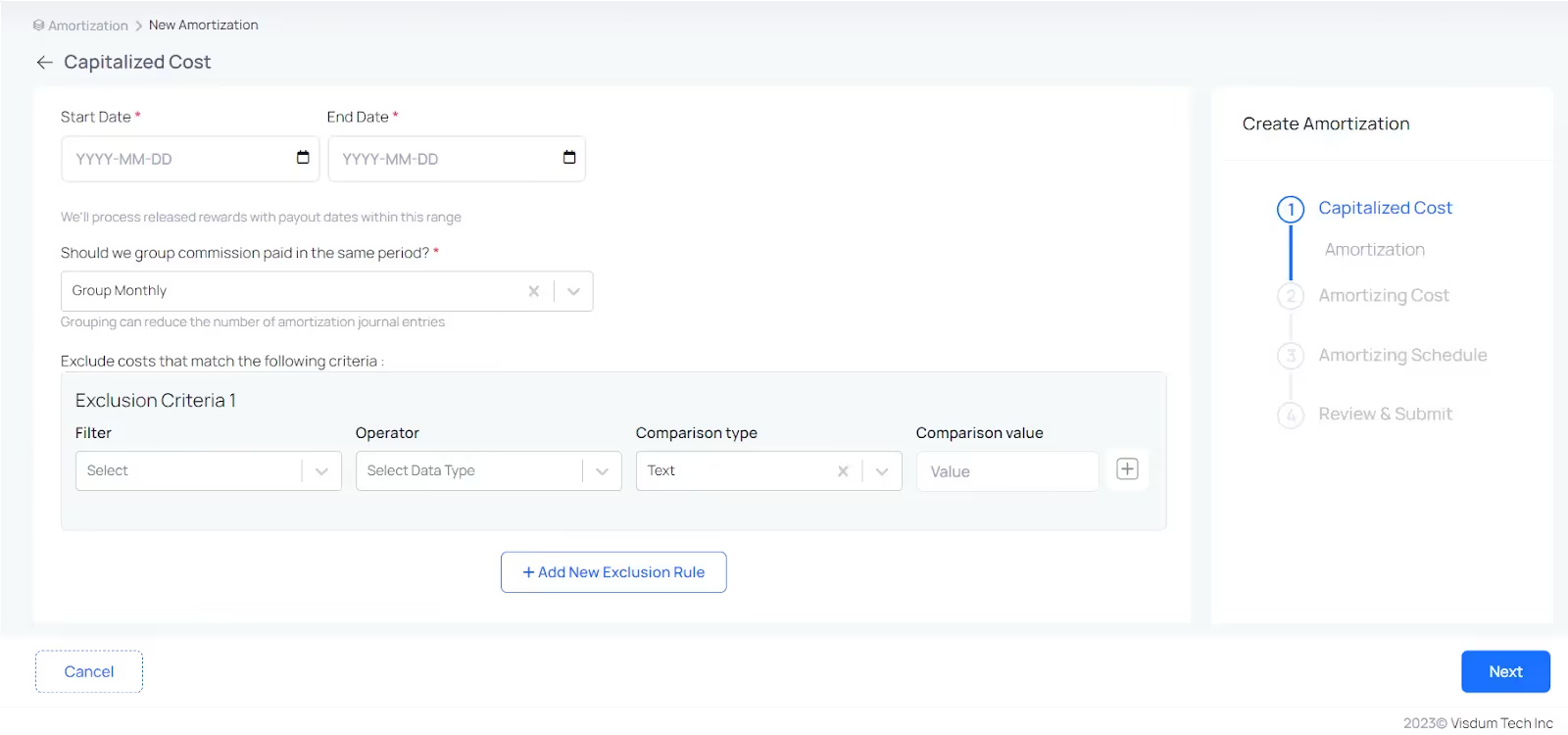

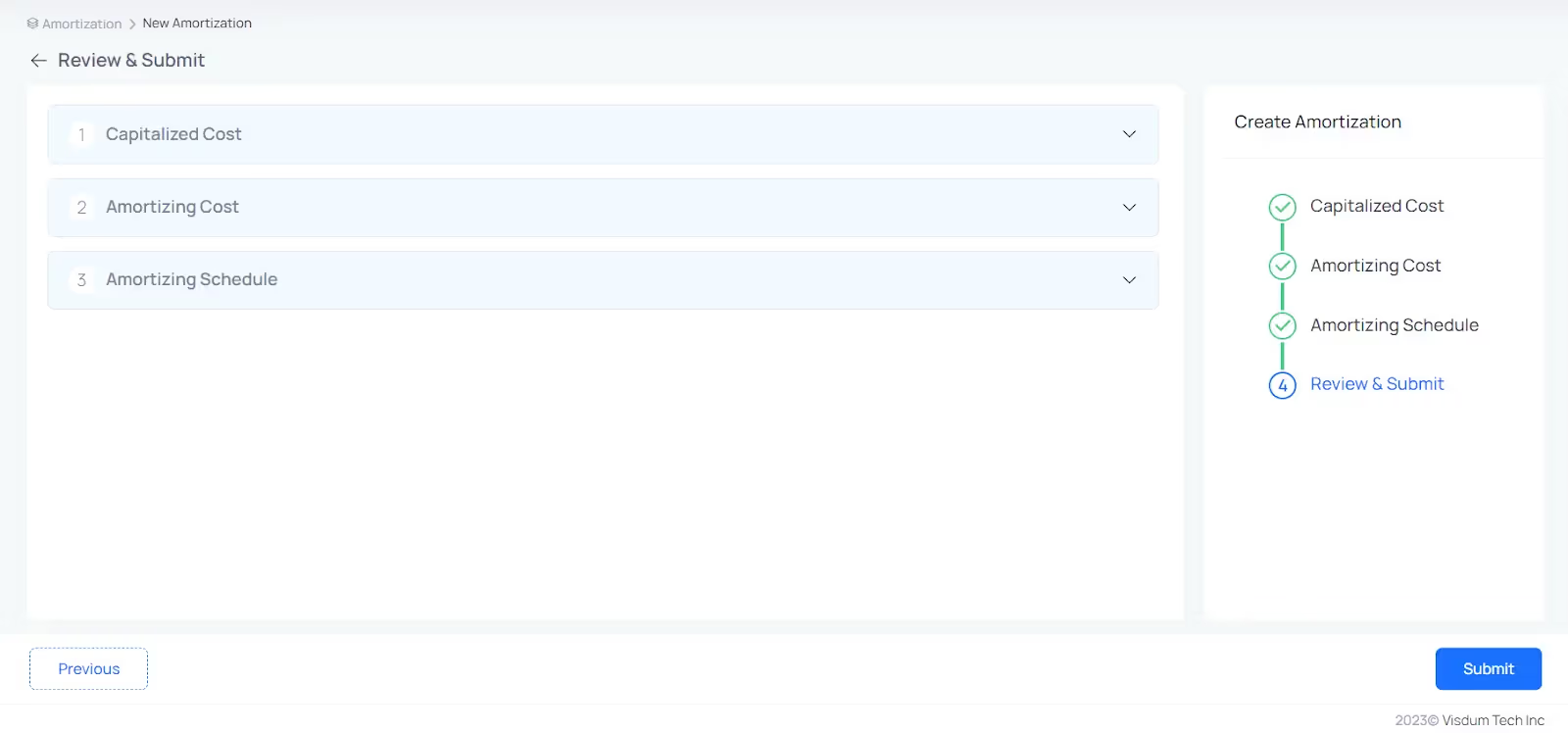

Automate Your ASC 606 Sales Commission Accounting in Three Simple Steps:

- Select your dates: Choose the commission dates you need to process. Whether it's monthly, quarterly, or yearly, we've got you covered.

- Customize your criteria: Effortlessly group transactions and set specific criteria to exclude certain commissions, like those paid to business development and customer success teams. Gain control over what you capitalize on.

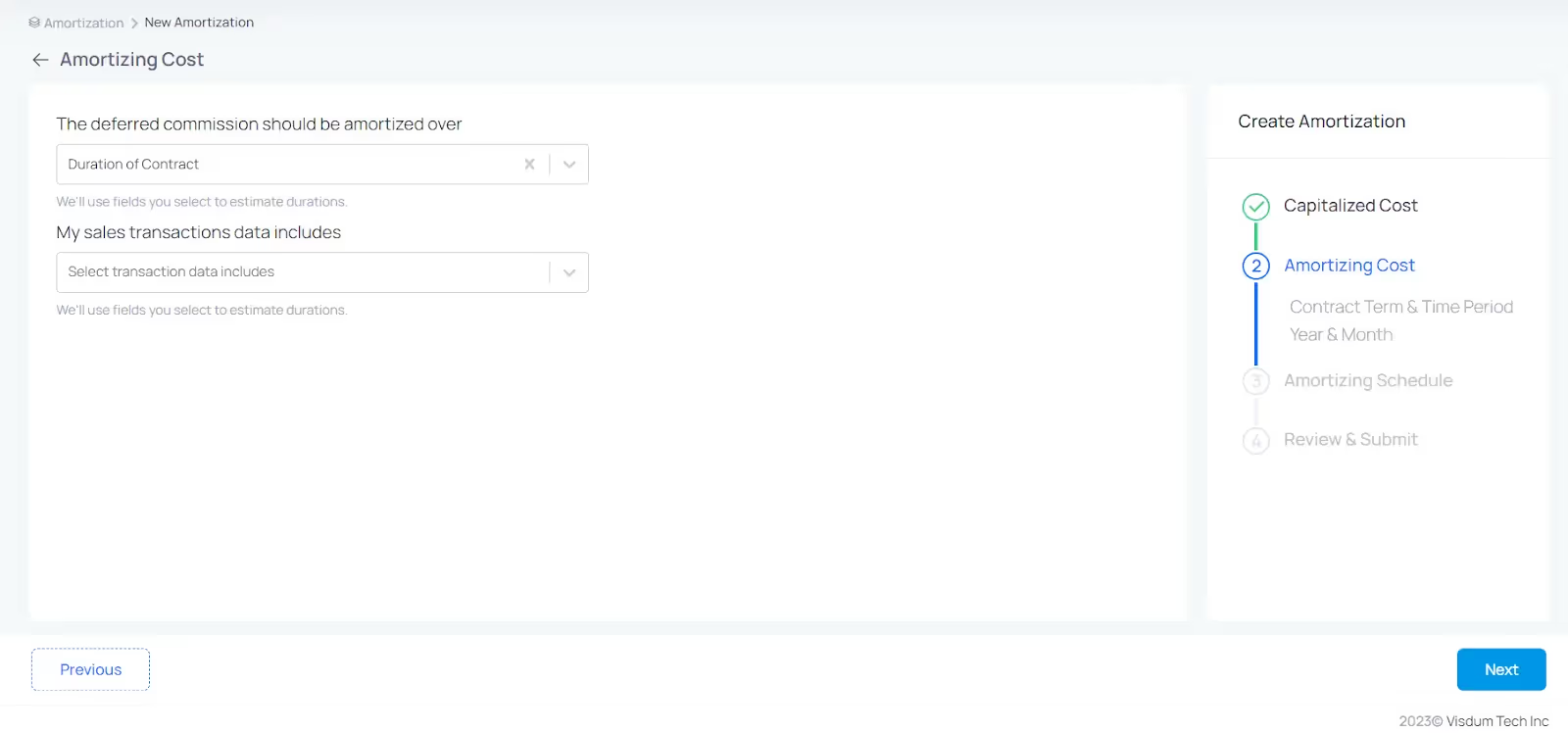

- Amortization choices: Decide how you want to amortize commissions over the contract period or the estimated lifetime of the customer relationship.

- Seamless data mapping: Easily map your data streams and generate comprehensive sales commission reports for full ASC 606 compliance.

Are you ready to revolutionize your sales commission accounting?

With Visdum, you're not just complying with ASC 606; you're setting a new standard in efficiency and accuracy for your financial operations.

Make the smart choice today.

Frequently Asked Questions

What is ASC 606 sales commission accounting?

ASC 606 enables recognizing select sales commissions as assets on the balance sheet if directly tied to securing a customer contract, then gradually expensing them over the contract's duration for accurate revenue recognition.

How do you record sales commissions?

Sales commissions are recorded as expenses when they're incurred and directly tied to getting a contract with a customer. If they're significant and benefit over time, they might be spread out gradually rather than all at once.

Can sales commissions be capitalized?

Yes, sales commissions can be capitalized under certain circumstances, according to ASC 606. If specific conditions are met, sales commissions that are directly attributable to obtaining a contract with a customer can be recognized as an asset on the balance sheet rather than expensed immediately.

Are sales commissions classified as period costs?

Not necessarily. Sales commissions can be classified as either period costs or capitalized as part of the cost to obtain a contract. If the commissions are directly tied to securing a contract with a customer, they're often treated as a cost to obtain that contract and recognized over the period benefiting from the contract.

Are commissions considered the cost of goods sold?

Commissions are generally classified as selling expenses, separate from COGS. They're expensed on the income statement, reflecting the costs of sales activities rather than direct production expenses.

Is sales commission a selling or administrative expense?

Sales commissions are typically considered a selling expense. They're directly linked to the sales force's efforts in securing contracts and generating revenue. Therefore, they fall under selling expenses rather than administrative expenses.

What is the difference between ASC 606 and ASC 842?

ASC 606 governs revenue recognition from customer contracts, while ASC 842 focuses on lease accounting. ASC 606 standardizes how companies record revenue, whereas ASC 842 requires organizations to recognize most leases on their balance sheets.

What is the ASC 606 revenue recognition checklist?

The ASC 606 revenue recognition checklist includes identifying customer contracts, determining performance obligations, establishing transaction prices, allocating prices to obligations, and recognizing revenue when obligations are satisfied. This ensures compliant revenue reporting across all transactions.

What are the 5 steps of ASC 606?

The 5 steps of ASC 606 are: 1) Identify the contract with the customer, 2) Identify performance obligations, 3) Determine the transaction price, 4) Allocate the transaction price to performance obligations, and 5) Recognize revenue when obligations are satisfied.

What is the ASC 606 standard?

ASC 606 is a revenue recognition standard implemented by FASB and IASB that creates a unified framework for recording revenue from customer contracts across industries. It replaced previous standards like ASC 605 to improve consistency in financial reporting.

.webp)

.webp)